This article is part of our Small Business Corner series, which is designed to address challenges and considerations regularly faced by owners of small- to mid-sized businesses. Check out past Small Business Corner articles at www.reacpa.com/small-business-corner.

How To Level Up Your Bookkeeping Game

If maintaining better books is the name of the game, QuickBooks® could be the power play your business needs to level up.

First things first though – if you’re looking to QuickBooks to take you to that next level – you’ll need to do more than click “install.” You’ll need to take time to really figure out which version is right for you. Additionally, once you’ve identified the right version, I recommend taking the time needed to customize the software to fit your specific business. Believe me – this is not a “one-size-fits-all program.”

QuickBooks can be really powerful, but its true magic lies in your ability to customize the program to address your unique challenges.

You Decide

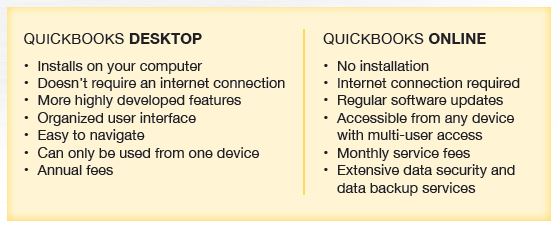

QuickBooks Desktop and QuickBooks Online both offer a lot of great features. This high-level comparison will help you determine which one is a better fit for you.

Generally speaking, I’ve found that product-based businesses need advanced inventory tracking tools and batch invoicing. If you’re in this camp, QuickBooks Desktop is most likely the right fit for you. QuickBooks Online is ideal for smaller, service-based businesses that don’t need inventory tracking or complex invoicing capabilities.

At the end of the day, your decision will come down to your business’s size, type, and needs.

Looking for a different solution? Learn how businesses are outsourcing critical business functions on this episode of Rea’s award-winning podcast, unsuitable on Rea Radio.

Which QuickBooks Option Will Take Your Business To The Next Level?

Skill Level: Beginner

Just because the software offers lots of bells and whistles, doesn’t mean you need to use everything out of the box. As a “beginner” QuickBooks user, simply focus on learning the basics. Take your time to implement the program’s tools correctly. This will help you stay focused. Some of the most important and powerful things you can do with QuickBooks occur at the beginner level. After all, if you don’t have a solid foundation upon which you can balance your bank account each month, you will be ill-equipped to truly take advantage of the program’s other features.

Skill Level: Intermediate

Once you’re confident that your numbers and reports are accurate, advance to level two. At this point, you’re ready to use QuickBooks to take your company to a whole new level by using the software to provide you with critical, timely reports. If cash is king and knowledge is power, using QuickBooks to monitor and manage your cash flow, accounts payable and accounts receivable can make you unstoppable.

Skill Level: Advanced

At this point, you should already be well versed in managing your company’s cash flow. You’ve locked into a pattern, your numbers are accurate and your reports are empowering. Now it’s time to use some of the other advanced features QuickBooks has to offer. As an advanced QuickBooks user, you’ll begin invoicing and maintaining the same format for each data entry. Using the invoice/sales receipt resources of the program will allow you to track the payments to your business while making it simpler to follow up on outstanding invoices.

If you’re looking to QuickBooks to take you to that next level, you need to do more than click “install.” You’ll need to take time to really figure out which version is right for you.

QuickBooks Is Great … But It’s Not Perfect

Regardless of which version of QuickBooks you decide to use, I believe you should work toward reaching the highest level at your disposal. After all, you have powerful tools and resources at your fingertips, it would be crazy to not take advantage of them, right? But be careful, with great power comes great responsibility.

These programs aren’t perfect, and I’ve discovered a few drawbacks throughout my many years of use. These pitfalls begin to show up as your business grows, and your financial requirements become more diverse. Be aware of the following shortcomings:

- Limited Reporting: Having a system that’s not fully integrated can limit access to data stored in other systems. This is evident with inventory data as it’s difficult for the program to compile the information in a meaningful way.

- Entry & Keying Errors: Many individuals use another system along with QuickBooks for their financial data entry. With that in mind, moving information from one system to another is no easy task and mistakes are just waiting to happen. Incorrect entries and keying mistakes will lead to incorrect business information and data loss.

- File & Data Size Limits: The software can slow down as substantial amounts of data are inputted into the system. This can be avoided by limiting the data file sizes and continually removing data over time.

- Support Shortcomings: Finally, support for the programs can be impersonal and not specific for your business needs.

If you want a deeper dive into the QuickBooks software options or have any questions about which version is right for you and your business, contact the accounting services team at Rea & Associates.

By Matt Long (Wooster Office)

Looking for more accounting and bookkeeping insight? Check out these resources:

Podcast: Zen And The Art Of Bookkeeping