Act Now To Mitigate Risk For Your Organization

Compliance enforcement continues to run rampant throughout the business community, particularly when it concerns a company’s I-9s. Why? Because Immigration and Customs Enforcement (ICE) isn’t just letting its presence be known at the border.

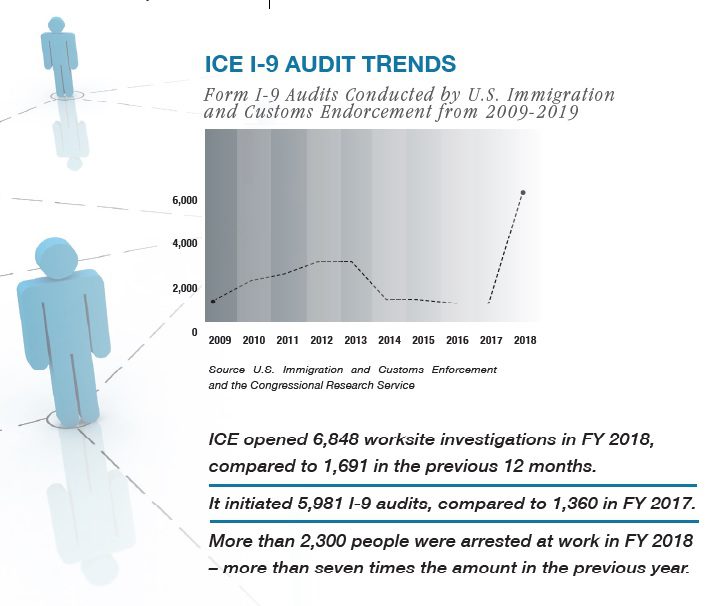

As demonstrated by the more than 5,200 I-9 audits performed last year, ICE is ramping up its inspections of business’ employment documents at a record pace. These I-9 inspections are meant to locate and fine employers who fail to follow immigration laws with regard to employment eligibility verification.

The number of I-9 audits performed on businesses has increased dramatically with ICE’s Homeland Security Investigations (HSI) division issuing more Notices of Intent to Fine than ever before, which means being proactive and preparing your business for an I-9 audit is the smartest action you can take.

What To Expect

For an I-9 audit to begin, the HSI division must first issue your business a Notice of Inspection. As the employer, this notice informs you that ICE will audit your employment records to determine if you’re in compliance with employment and immigration laws. Upon receiving a Notice of Inspection, you have three days to provide your business’s I-9 forms for inspection.

Receiving a Notice of Inspection can be daunting, especially if you’re not prepared. Here is what you can expect:

- You’ll be required to provide your business’s I-9 forms and any other supporting documents, such as employee lists, business licenses and payroll records.

- You’ll have a strict 72-hour period after you’ve received the notice to provide the requested documents to ICE.

- If basic violations are revealed, you’ll have a 10-day window to correct them. If violations aren’t fixed within 10 days, you’ll incur a fine ranging from $220 to $2,191 per violation. Additionally, if you knowingly hired and continued to employ unauthorized workers, penalty fines are much greater. If discovered, you can face fines ranging from $548 to $19,242 per violation.

Without the proper documentation and preparation, I-9 audits can cripple your business. However, it’s important to note that ICE considers the following factors when determining the fines it will levy on a business:

- The size of the business

- Good faith effort to comply

- The severity of the business’s violations

- Whether the violation involved unauthorized workers

- The business’s history of previous I-9 violations

Best Practices

With the heightened enforcement of HR and I-9 compliance, it’s critical to take the necessary steps to prepare your business for an I-9 inspection so you can avoid paying penalties to the government.

- Train your staff to follow your business’s written I-9 compliance policy.

- Educate your employees on the proper ways to verify documents and handle all job applicants the same.

- Implement a cataloging method to properly sort and retain completed I-9s.

- At least once a year, go through and get rid of old I-9 forms that are past their retention period (three years from date of hire or one year after termination).

- Perform self-audits and document each one after completion. Seek assistance from a professional who can provide a structured method for auditing and compliance.

Increased enforcement of I-9s is likely to continue and no business should feel exempt from an I-9 audit. Maintaining a culture of best practices and compliance should be top priority.

Helpful Resources

If you’re trying to prepare your business for an I-9 audit, review these online resources:

- The central hub for all things related to the Form I-9: www.uscis.gov/i-9-central/

- Sites designed to help you comply and evaluate updates and policy changes: www.worker.gov / www.employer.gov

- Guidance for employers on how to complete Form I-9: https://www.uscis.gov/i-9-central/handbook-employers-m-274

Rea’s HR consulting services team can help you mitigate risk by helping your business comply with federal regulations before receiving a Notice of Inspection in the mail. To avoid the extreme cost associated with such violations, we can provide documentation and recommendations to help ensure complete I-9 compliance. If you have questions about I-9 compliance

or increased enforcement, talk to a human resources professional.

By Renee West, SHRM-SCP, PHR (New Philadelphia office)

Check out these other resources for additional HR insight:

Motivate Employees With Effective Performance Appraisals

Are You Failing Your New Employees?

Build A Strong Organization With An Interview Plan