A Brighter Way Group Plan Solution

WHAT IS A BRIGHTER WAY 401(K) GROUP PLAN SOLUTION?

A Brighter Way 401(k) Group Solution Plan (GPS) is a collection of single-employer defined contribution plans that, through a pooled plan arrangement, may share a common plan administrator, named fiduciary, investment menu, plan year, and trustee. Participating employers do not have to share a common association or industry. This pooled-plan solution is designed to reduce the administrative burden, transfer certain risks, and potentially lower the overall plan cost. It brings together a team of professionals on an employer’s behalf so they can focus on what matters most: running their business — not their retirement plan.

Review This Quick Guide to Pooled Plan Araangements

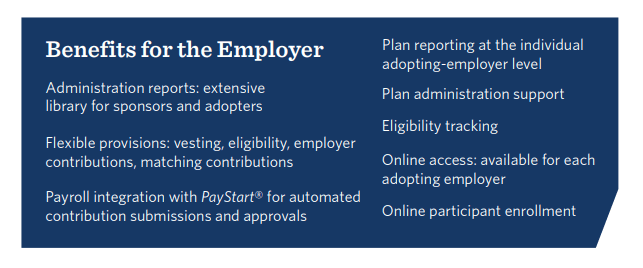

Each adopting employer signs an agreement to adopt a plan document under the GPS, and each employer is viewed as adopting its own plan for certain regulatory purposes. All component plans use the same service providers and investment vehicle—giving them the potential to enjoy cost savings through economies of scale.

WHY SHOULD YOU CONSIDER A BRIGHTER WAY 401(K) GROUP PLAN SOLUTION?

BENEFITS TO PLAN ADVISORS:

A Brighter Way 401(k) GPS gives you the opportunity to successfully scale your retirement plan advisory practice, which can help to increase your firm revenue and profitability. An ERISA 3(38) investment manager handles discretionary fund selection and monitoring using low cost institutional funds eliminating the burden on you and your client. The 3(38) manager is CEFEX-certified and has created a custom target date collective investment trust series with conservative, moderate and aggressive options for each vintage.

All fund monitoring and quarterly investment manager reports are provided for your periodic client reviews, saving you hours of review and prep time, and letting you focus on meeting with your client and improving plan metrics such as employee participation, deferral rates and optimizing asset allocation where the greatest opportunities are for improving participant outcomes.

Check out this video to learn more!

BENEFITS TO PLAN SPONSORS:

A Brighter Way 401(k) GPS gives your employees the best opportunity to successfully save for retirement through simplicity & transparency, scale, flexibility, and responsive local service. It is based on the fiduciary best practices and processes of Rea’s own 401(k) plan, which has above-average participation and contribution rates at below-average costs.

A Brighter Way 401(k) GPS will allow you to adopt a 401(k) platform that is competitively priced, incorporates industry best practices for plan management and is designed by CPAs who value and understand a prudent process and transparency.

Check out this video to learn more!

To learn more about managing your fiduciary risk as a plan sponsor through the GPS, we invite you to download the whitepaper written by The Wagner Law Group offered courtesy of Transamerica.

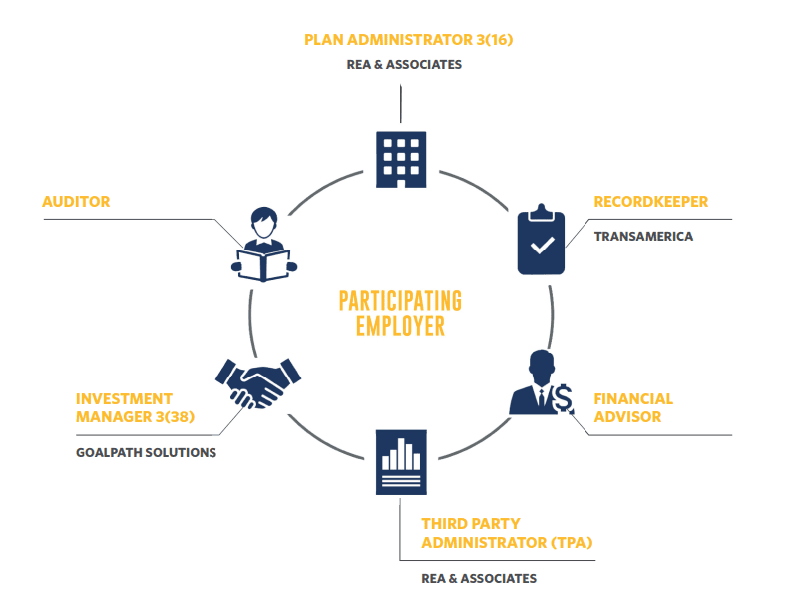

Your Dedicated Team

Roles of the Professional Services Team

Plan Administrator – Rea & Associates

- Serves as named fiduciary

- Performs administrative functions to keep plan compliant

- Responsible for day-to-day plan operations, including

- Completion, signing and filing of Form 5500

- QDRO determinations

- Benefit payment authorization

- Ensuring proper spousal consent obtained for payments

- Distributions

Record Keeper – Transamerica

- More than 85 years of experience in retirement

- Pioneer and market leader in pooled plans

- Created pooled-plan solutions starting in 2001

- Provides support to plan participants to and through retirement

Financial Advisor – Selected by the plan sponsor

- Helps the sponsor determine plan objectives, options for plan design enhancements, and monitor plan statistics

- Offers services to help increase plan participation

- Lends support with a comprehensive education program for employees

- Provide services such as benchmarking of fees and services, and deliver 3(38)-provided investment reviews

- Helps ensure the plan sponsor understands the importance of providing year-end data to the Third-Party Administrator for the timely completion of all required testing/filings

Third-Party Administrator – Rea & Associates

- Helps adopting employers with plan design

- Provides ongoing compliance services, including mandatory testing and administration

- Offers local support for employer

Investment Manager – GoalPath Solutions

- Responsible for the selection and monitoring of funds in the investment lineup

RESPONSIVE LOCAL SERVICE FROM A PROVEN LEADER

Rea & Associates has been certified by the Centre for Fiduciary Excellence (CEFEX) as adhering to the industry’s best practices for Third Party Administrators. Certification means that we undergo annual assessments to verify our continued adherence to the ASPPA Standard of Practice for Retirement Plan Service Providers. Excellence is part of our culture and we strive for it by continuously improving every aspect of our business. This certification is proof that Rea delivers industry-leading care to our retirement plan clients. Our CEFEX certification emulates annual due diligence to ensure increased efficiency, operational consistency, improved decision making and accountability for our processes.

Additionally, as a multi-year winner of ClearlyRated’s Best of Accounting® award for client service excellence, Rea’s client satisfaction scores are nearly double the industry average. We pride ourselves on our outstanding client service and we guarantee that your emails and phone calls will be returned within 24 hours – if not sooner.

Disclosures

The GROUP PLAN SOLUTIONSM (GPS) is not a multiple employer plan (MEP). Unlike a MEP, certain plan qualification and ERISA requirements are applied at the individual plan level. An employer participating in a GPS retains certain fiduciary responsibilities, including responsibility for retaining and monitoring the 3(16) plan administrator, for determining the reasonableness of its fees, and for periodically reviewing the GPS as a whole. Transamerica does not act as a 3(16) plan fiduciary.

Before adopting any plan, sponsors should carefully consider all of the benefits, risks, and costs associated with a plan. Information regarding retirement plans is general and is not intended as legal or tax advice. Retirement plans are complex, and the federal and state laws or regulations on which they are based vary for each type of plan and are subject to change. In addition, some products, investment vehicles, and services may not be available or appropriate in all workplace retirement plans. Plan sponsors and plan administrators may wish to seek the advice of legal counsel or a tax professional to address their specific situations.

Choosing a pooled plan does not eliminate the need for plan sponsor to determine whether a plan is appropriate for their specific circumstances. No investment decision should be made based on this information without first obtaining appropriate professional advice and considering the circumstances. Contact your tax advisor, accountant and/or attorney before making any decisions with tax or legal implications.

Information contained herein may have been obtained from a range of third-party sources and is believed to be reliable but not guaranteed.

GoalPath Solutions is an independent Registered Investment Advisor performing as the plan’s 3(38) investment manager. As a named fiduciary to the plan, GoalPath is responsible for selecting, monitoring, and ongoing due diligence of funds in the lineup.

Logos and trademarks are the intellectual property of their respective owners. Rea & Associates, GoalPath Solutions, Transamerica and The Wagner Law Group are unaffiliated.