Retirement Plan Advisors

Which Retirement Plan Team Would You Refer To Your Clients?

Your clients trust you and your judgment. You can’t afford to recommend a retirement plan team that doesn’t offer comprehensive services and exceptional client support.

Your clients trust you and your judgment. You can’t afford to recommend a retirement plan team that doesn’t offer comprehensive services and exceptional client support.

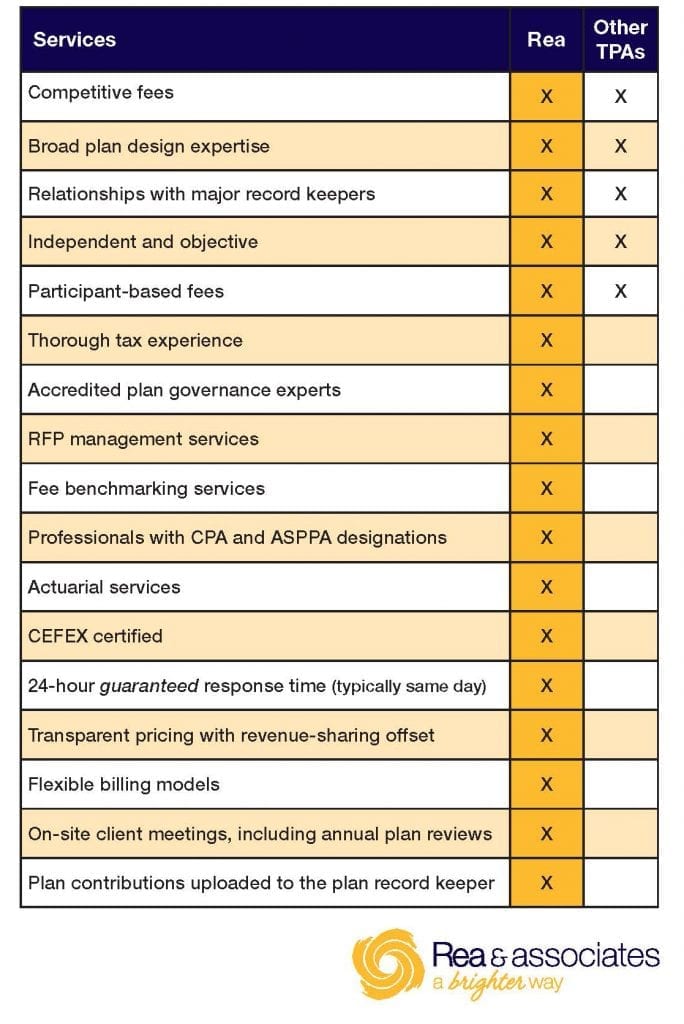

For more than 80 years, Rea & Associates has been committed to accuracy, integrity and unparalleled client service. Our retirement plan administration team builds on this foundation and adds dedication to retirement plan best practices and services beyond what you would normally expect from other retirement plan specialists.

We can custom design a plan that works for your clients and their companies. Our team of retirement plan administrators help to ensure businesses are compliant by explaining all current regulations, responsibilities and fiduciary issues.

Our team has vast retirement plan design knowledge, and we handle all communication with clients and prospects as well as provide all plan illustrations allowing advisors to concentrate on the investments. Our goal is to satisfy the needs of all participants.

The professionals at Rea can be as involved as needed, which allows clients the flexibility and peace of mind they need.