Insight Tag: Accounting & Bookkeeping

Article

The Hidden Threat to Your Construction and Real Estate Profits: ACH Fraud Exposed

Cybercriminals are increasingly targeting the construction and real estate industry. One of the most prevalent threats? ACH fraud. Here's what you need to know to protect your business

Article

Securing Your Business Legacy: The Essential Guide to Exit Planning

As a business owner, you've poured your heart and soul into building your company. But have you given thought to what happens when it's time to step away? Exit planning is a crucial step that many entrepreneurs overlook, often until it's too late. Let's dive into why exit planning matters and how you can start preparing for your business's future today.

Article

Ohio’s Extended Tax-Free Holiday: What Restaurants and Businesses Need to Know

This summer, the Buckeye State is rolling out an expanded tax-free holiday that promises to boost sales and offer substantial savings. But there are also some challenges that businesses should be aware of. From July 30 to August 8, 2024, Ohio will suspend sales tax on a wide range of items, including dine-in restaurant meals. Let's dive into what this means for your business and how you can make the most of this opportunity and avoid potential problems.

Article

Mastering Inventory Management: The Key to Manufacturing Success

Inventory management is a critical component that can make or break a company's success when it comes to manufacturing. Effective inventory management ensures that you have the right materials, in the right quantities, at the right time, and in the right place. By mastering this essential aspect of your operations, you can reduce costs, improve efficiency, and ultimately, boost your bottom line.

Article

The Hidden Cost of Doing Business in Multiple States: A Tax Perspective

As a business owner, expanding your operations into new states can be an exciting prospect. However, with growth comes new responsibilities, including the obligation to file taxes in those states. Unfortunately, not all businesses are aware of the potential pitfalls and risks associated with state and local taxes, leaving them vulnerable to scams and costly mistakes.

Article

Metrics That Matter: Assessing Your Not-for-Profit’s Fundraising Health

Effective fundraising is critical for many not-for-profit organizations to fully fund their programs and execute the mission. But how do you know if your fundraising efforts are effective, and you are using the best strategy? Analyzing key fundraising metrics can provide valuable insights to help you optimize your approach and get the most out of your fundraising investments.

May 27, 2024

Article

Building Your Budget: Moving Forward & Putting It All Together

Welcome to the second installment of our Comprehensive Budget Series. Previously we explored the why, when, and how of budgeting. In this article, we’ll focus on the practical steps involved in building a budget that aligns with your goals and supports your organization’s financial health. We’ll discuss strategies for allocating resources, making informed decisions, and addressing challenges that may arise during the budgeting process. No matter what type and size business you’re managing, the principles and techniques covered here will help you create a budget that sets you on a path to success.

Article

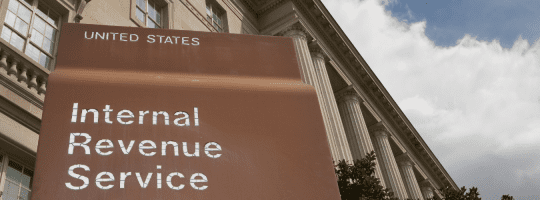

Navigating IRS 1099 TIN Mismatch Letters: What You Need to Know

The IRS has recently issued a series of 1099 TIN mismatch letters, also known as CP2100 and CP2100A notices for 2022 and 2023, indicating a ramp-up in enforcement and penalties related to 1099 filings. These notices can lead to significant compliance obligations, so understanding what they mean and how to respond is crucial for maintaining compliance and avoiding penalties.

Article

The GASB Approves Statement No. 103 on the Financial Reporting Model

In its April 2024 meeting, the Governmental Accounting Standards Board (GASB) approved the issuance of Statement No. 103 regarding changes to the financial reporting model. The new standard will revise and build upon the requirements in GASB Statement No. 34. The full standard will ultimately be published on the GASB’s website. Key changes in the … Continued

Jun 3, 2024

Other Stuff

Koontz & Parkin joins Rea & Associates FAQs

Rea & Associates offers services far beyond that of a traditional accounting firm, including information services, managed IT, retirement plan consulting, wealth management solutions, as well as valuation and transaction advisory services.