House Republicans have finally gone public with their long-awaited plan for tax reform and the Senate has their version. Included in the House document are plans to kill the estate tax. How do they plan to get the job done, you ask? Well, according to the proposed bill, the attack on the estate tax will take place on several fronts. First, the current exemption of $5.49 million for individuals and the $11 million exemption presently in place for married couples will be doubled. Then, after six years, the tax would be eliminated entirely. In the Senate plan, it does not set limits.

But before we get too far ahead of ourselves, we need to accept that such a major maneuver will not be easily executed – if at all. The estate tax has been part of America’s Tax Code since 1916 and impacts only a few of the nation’s wealthiest people. Therefore, total elimination of the tax is a long shot. Also, if there is a new President and Congress in 2020, the threshold can easily be changed.

The Senate And House GOP Tax Plans

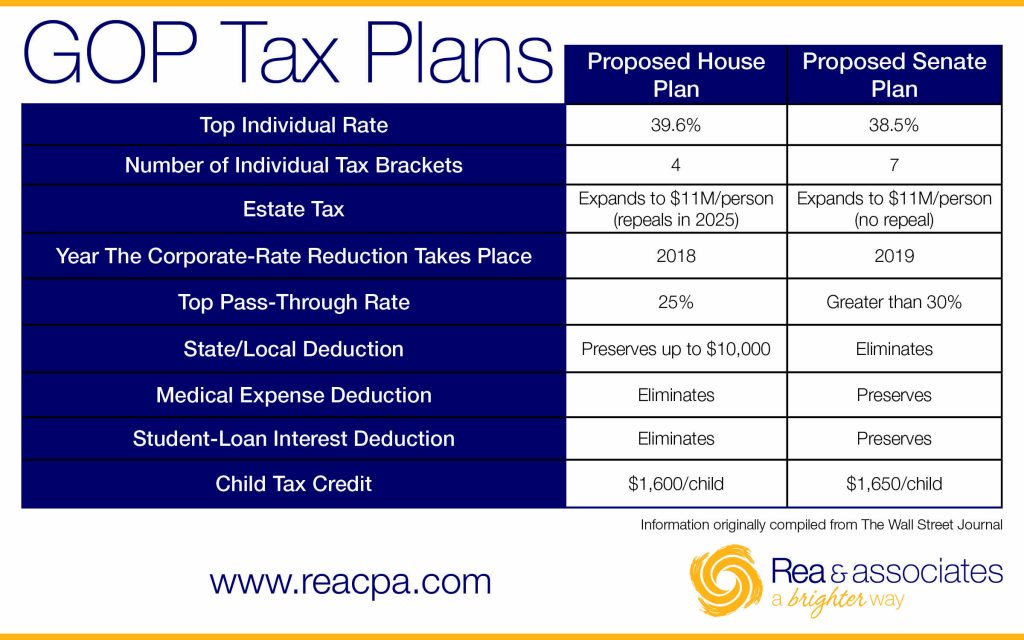

The Senate and House GOP have released tax plans that differ in key aspects. These differences are present with the timing of corporate tax rate cut, the number of individual tax brackets, the details of international tax rules and what changes should be made to the estate tax.

The following table shows what the Senate and House GOP tax plans are proposing:

The Center on Budget and Policy Priorities reports that “only the estates of the wealthiest 0.2 percent of Americans – roughly two of every 1,000 people who die – owe any estate tax. This is because of the tax’s high exemption amount, which has jumped from $650,000 per person in 2001 to $5.49 million per person in 2017.

So what does this mean for the small business owner?

Well, if you are you making plans to begin your estate planning strategy or gifting your assets it’s not going to hurt to keep an eye on the GOP proposal to find out how the dust will actually settle. But I wouldn’t recommend postponing any plans just yet – if ever. After all, what are the chances that a tax that only impacts a few people and has been around for the last century goes away forever? I guess the Cleveland Browns always have a chance to win the Super Bowl too…

So, if you wish to pass along your business to your children, do not let these tax law proposals stop you from making gifts. Especially if you feel your business will appreciate in value in the future. And, in the meantime, if you do have additional questions related to this topic, feel free to email Rea & Associates or reach out to a member of our firm’s business valuation team directly.