New Draft W-4 For 2019 May Trigger Payroll Systems Updates

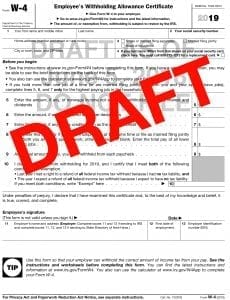

The IRS released a draft version of its 2019 Form W-4, the form used to record an employee’s marital status and withholding amounts for federal income tax purposes. And, as you can imagine, many were less than thrilled to learn of the changes.

As you already know, the Tax Cuts and Jobs Act effectively overhauled many of our well-known tax regulations. Well, in doing so, changes have to be made to ensure that employees are reporting the necessary information to their employers and the government as well.

If you take a look at the draft 2019 version of Form W2 and compare it to the 2018 version of the form, you will notice quite a few modifications, including:

- ‘Number Of Allowances’ Option Removed – Line 5, “Total number of allowances you’re claiming,” has been removed from the 2019 Form W-4. This change will most likely have a prominent impact on individuals moving forward.

- New Marital Status: ‘Head Of Household’ Box – A new, additional IRS withholding table will be added with this new marital status as an option.

- New Additions To ‘Income’ Line – With this line, employees are required to enter their estimated nonwage income not subject to withholding and estimates must reflect the full year. That means, for 2019, your payroll systems will need to be updated to accommodate full-year totals in the calculations.

- New ‘Deductions’ Line – Similar to before, employees filling out the 2019 W-4 will need to enter full-year deduction totals for this line. Once again, your payroll systems will need to accommodate the full-year amounts for calculations.

- New ‘Tax Credits’ Line – Previously, employees would put tax credits into additional withholding allowances. Now, full-year tax credits totals will be directly processed into payroll systems.

Looking Ahead

This information is really only to let you know what’s currently out there and to help employers prepare for changes. Feel free to review the document, call us with questions and share your feedback. Don’t give the draft version of the 2019 Form W-4 to your employees because there’s a possibility it could still change. Instead, please wait for the green light from the IRS before sharing the new Form W-4 with your employees. Additionally, do not use the new version of the form for payrolls dated before 2019.

If your employees need help calculating their full-year deductions or nonwage income, point them in the direction of the IRS’s financial calculators. They are free, easy to use and (dare we say) fun!

If you have other questions related to the Draft W-4 Form for 2019, email Rea & Associates to be put into contact with one of our tax experts.

By Dee Gray (New Philadelphia office)