Uniform Guidance Zeroes In On Written Policies & Procedures

As a public entity, you’ve been expected to adhere to a variety of policy and procedural changes since the Uniform Administrative Requirements, Cost Principles and Audit Requirements for Federal Awards took effect in December 2014 by the United States Office of Management Budget (OMB). But, believe me, even though it’s been a few years, there’s still plenty to be confused about – especially with regard to Uniform Grant Guidance (UGG).

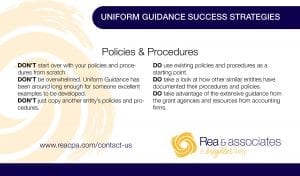

The changes resulting from UGG, as you already know, have been extensive; but perhaps the most notable change is that your entity must have written policies and procedures in place related to the actual compliance requirements now on the books – even if you have yet to be subjected to an single audit. That being said, if we are to look for a silver lining, it’s that having a comprehensive record of your organization’s policies and procedures is actually a good thing, particularly for those looking to improve internal controls and reduce the likelihood of misused funds.

Read Also: 5 Methods For Procurement Success

Uniform guidance puts emphasis on policies and procedures as central in its objective to maintain effective internal controls over federal awards.

The following is a brief overview of the key changes to be aware of with regard to your written policies and procedures. If you haven’t already, make it a priority to adopt or update the following policies and procedures.

Compensation Policy

To be applied consistently to federal and non-federal activities, this policy should ensure that compensation is reasonable and made in accordance with established organizational policies. All salaries and wages charged to federal awards must be accompanied by reasonable assurance that personnel costs are incurred in a way that is accurate, allowable and properly allocated.

Fringe Benefits Policy

This written policy must consistently describe the method of cost allocation with regard to any fringe benefits allocated to federal awards.

Travel Costs Policy

A written policy must be put into place if travel costs are charged to the federal award. Documentation must justify that participation of the individual is necessary and that the costs associated with travel are reasonable and consistent with the entity’s established travel policy.

Conflicts of Interest Policy

Written policies addressing conflicts of interests should contain two parts. The first should cover your entity’s employees and the second should cover potential conflicts of interest and from an entity-wide level. It must also address disciplinary actions association with violations.

Record Retention and Access Policy

This policy must define the period of time by which an entity’s records must be kept (and time can vary by the particular grant agreement). All records relating to a particular federal award, including financial records, property purchased, supporting documents, statistical records, etc., must be maintained for three years from the final expenditure report’s submission date.

Allowable Costs Procedure

Determines whether your entity has written procedures that document how compliance is ensured. A number of factors that should be considered when evaluating allowable costs.

Financial Management Procedure

Includes records that document compliance and the tracing of funds to determine whether they’ve been used in accordance with federal statues, regulations and the terms and conditions of the federal award. Records should include the:

Title of the award

Catalog of Federal Domestic Assistance (CFDA) number

The source and application of funds for all federally funded activity.

Advance Payments and Reimbursement Procedure

Outlines your procedures for collecting payments of federal funds as well as your entity’s responsibility with regard to advance payments versus reimbursements.

Purchasing and Procurement Procedure

Federal regulations on purchasing and procurement now require a documented, detailed set of practices that promote full and open vendor competition to maximize cost effectiveness.

Equipment Procedure

To detail the management of any equipment used, inventory records, the method of disposal and the use of funds from the disposal of equipment purchased with federal funds.

Mandatory Disclosure Procedure

All violations of federal criminal law that involve fraud, bribery or gratuity violations that potentially affect the federal award must be identified and disclosed in a timely manner, in writing, to the federal awarding agency or pass-through entity.

Even though your entity may already have many of these written policies and procedures in place, it’s also important to review them and make sure they comply with Uniform Guidance. Failure to establish yours could result in a management letter comment and a potential audit finding. Furthermore, revisiting your policies and procedures doesn’t just help keep the auditors off your back. Taking the time to ensure that your t’s are crossed and your i’s are dotted will put your entity in a great position when someone new steps in, which will ultimately maximize your time and resources.

Email Rea & Associates to find out more about Uniform Guidance and to find out if your existing policies and procedures comply with these new rules.

By: Jennifer Kasserman, CPA (New Philadelphia office)

Looking for more insight to help guide your entity to efficiency and success? Check out these articles:

Uniform Grant Guidance: What All Government Entities Need To Know