Financial Resources For Employers Impacted By COVID

While the COVID crisis continues to impact businesses large and small, government entities and lending institutions are working hard to provide relief. Please review the following information for insight into the resources that are currently available to your business.

While the COVID crisis continues to impact businesses large and small, government entities and lending institutions are working hard to provide relief. Please review the following information for insight into the resources that are currently available to your business.

Remember, as you consider which option is right for your situation, know that the funds are only available for working capital losses due to the virus. They are not to be used for the expansion of operations or consolidation of debt. In short, this financial assistance can be used to support ongoing operations and to cover the costs/expenses that are necessary to stay afloat. Private nonprofits are also eligible to receive SBA disaster relief.

Financial Assistance For Small Businesses

A key tool in America's economic recovery toolbox has been the Paycheck Protection Program (PPP), which came into existence as a way to provide financial relief to businesses with 500 or fewer employees, not-for-profit organizations, veterans' organizations, tribal concerns, self-employed individuals, sole proprietorships, and independent contractors. The original deadline to apply for these funds was June 30, 2020. However, as a result of the continued need demonstrated by organizations that had suffered economic hardship due to COVID, the government pushed the deadline to apply for these funds to Aug. 8, 2020. Additionally, on May 15, 2020, the Small Business Administration released its much anticipated PPP Loan Forgiveness Application. Most recently, the Consolidated Appropriations Act was passed on Dec. 27, 2020, for the purposes of helping countless businesses still reeling from the COVID crisis. Read on to learn more about this legislation.

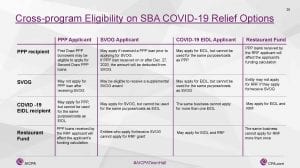

Cross-Program Eligibility On SBA COVID-19 Relief Options

The American Institute of CPAs (AICPA) held a town-ball meeting on May 22, 2021. During that program, tax professionals shared a lot of helpful insight for CPAs as well as employers. The slide presented below, published with permission from the AICPA, shows the programs business owners of all types can apply for while funds are still available. Check it out below and reach out to your Rea CPA for additional insight or if you are looking for help to apply for assistance.

Click on the image to see the full-sized version.

Paycheck Protection Program 2.0

As a result of the ongoing financial hardships businesses are facing, legislators put forward the Consolidated Appropriations Act of 2021. This piece of legislation addresses the tax-deductibility of PPP loan forgiveness expenses, automatic forgiveness of loans less than $150K, second draw loans, extended program eligibility, and more. For your convenience, the Rea PPP task force has provided an overview of the program and additional provisions you should be aware of moving forward. To read the overview, click here.

First Draw Loans

IMPORTANT: The Small Business Administration (SBA) reopened the Paycheck Protection Program (PPP) during the week of Jan. 11, 2021, for "First Draw Loans," First Draw PPP loans can be used to help fund payroll costs, including benefits. Funds can also be used to pay for mortgage, interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations. To view more information on First Draw PPP loans, including the full forgiveness terms, who can apply, and more. Click here to read about PPP First Draw Loans.

>>> Paycheck Protection Program (First Draw Loan) Application <<<

Second Draw Loans

IMPORTANT: Per the Consolidated Appropriations Act of 2021, the PPP now allows certain eligible borrowers that previously received a PPP loan to apply for a Second Draw PPP Loan with the same general loan terms as their First Draw PPP Loan. These Second Draw PPP Loans can be used to help fund payroll costs, including benefits. If you would like to learn more about Second Draw PPP Loans, click here.

>>> Paycheck Protection Program (Second Draw Loan) Application <<<

Restaurant Revitalization Fund Grants

Included in the American Rescue Plan Act of 2021, was a special order of grant money that was specifically set aside for restaurants that have sustained financial losses resulting from the COVID-19 pandemic. The U.S. Small Business Administration (SBA), which is in charge of administering the funds, has been busy putting the final touches on the official application for the Restaurant Revitalization Fund Grants (RRFG) and, once it goes live, the government agency will begin taking orders, so to speak, on a first-come, first-served basis. Click here to find out if your restaurant qualifies to receive a slice of the $28.6 Billion grant and how to apply!

Additional Resources For Small Businesses

Looking for more assistance and insight, please check out the links below to learn more about the financial resources that are now available to employers.

Employee Retention Credit Eligibility Tool

Small Business Administration's Disaster Relief Loans

Paycheck Protection Program (PPP)

Paycheck Protection Program Loan Forgiveness Application

Paycheck Protection Program Flexibility Act

IRS Issues Guidance That Impacts Deductibility Of Expenses Related To PPP Loan Funds

AICPA's PPP Loan Forgiveness Calculator

Finally, as it relates to the CARES Act, we have found a very helpful FAQ document, The Small Business Owner's Guide to the CARES Act, from the Senate Committee on Small Business and Entrepreneurship. Please take a look as it will likely answer many of the questions you may have about the CARES Act and its impact on your small- to mid-sized business.

Main Street Lending Program

The Main Street Lending Program is a new loan program that was recently announced by the Board of Governors of the Federal Reserve with financial support from the Department of the Treasury. Here is a high-level overview:

- This program is available for any business that was established prior to March 13, 2020, and has:

- Up to 15,000 employees OR

- 2019 annual revenues of less than $5 billion

- You must have at least $83,333 in EBITDA in 2019 to qualify.

- The amount you can borrow is 6x your EBITDA minus your funded debt or credit lines (no including PPP) on the date you apply for the loan.

- The minimum loan amount is 6x EBITDA, or $500,000.

- The maximum loan amount is $25 million

- There are no prepayment penalties.

- This program can be leveraged alongside PPP and EIDL programs.

The terms of the loan are as follows:

- 4 years

- LIBOR (1 month or 3 months) plus 300 basis points, depending on the underwriting

- No payments due for the first 12 months (unpaid interest will be capitalized)

- Principal amortization of at least 15 percent at the end of the second year, 15 percent at the end of the third year, and a balloon payment at 70 percent at the end of the fourth year

- No forgiveness opportunities

More information from the Federal Reserve: Policy Tools | Press Release

If you think this program might be applicable to your situation, please contact your Rea advisor.

Free On-Demand Webinars

The PPP & CARES Act task force has been working hard to provide businesses like yours with essential information related to the Paycheck Protection Program and other cash flow generating activity. Check out these free on-demand webinars from financial experts and industry specialists for guidance.

The Rea & Associates team is also producing webinars on a variety of other topics. Click here to check out past recordings and to register for future events.

- Understanding The Employee Retention Credit - Released Jan. 13, 2021

- What Does The New Stimulus Bill Mean For Businesses? - Released Jan. 7, 2021

- PPP Loan Forgiveness Application Process, Necessity Form & Tax Treatment - Released Dec. 8, 2020

- New CARES Act Funding To Help Small Business & Nonprofits - Released Nov. 6, 2020

- Attaining Your Post-COVID Business Goals: The Transition From Uncertainty To Success - Released Aug. 25, 2020

- Managing Business Growth & Profitability In A COVID-19 World - Released Aug. 18, 2020

- Recovering & Prospering In A COVID-19 World - Released June 30, 2020

- Paycheck Protection Program: The Final Chapter? - Released June 26, 2020

- Working Through The PPP Forgiveness Application - Released May 26, 2020

- Navigating PPP Forgiveness & Certification Guidance - Released May 14, 2020

- Navigating PPP Forgiveness & Intro to Main Street Lending Program - Released April 28, 2020

- Navigating Your Bank Relationships & PPP Loan Forgiveness - Released April 15, 2020

- How To Claim SBA Disaster & CARES Act Loans - Recorded March 31, 2020

Ohio Small Business Development Centers

Here is a list of several of Ohio's Small Business Development Centers. Please let us know if you would like us to include additional counties.