Insight Tag: Tax

Article

Inside the Inflation Reduction Act of 2022: Key Provisions That Could Impact Your Taxes

On Friday, Aug. 12, the U.S. House of Representatives voted to pass the Inflation Reduction Act, after being passed by the Senate earlier this month. The bill is much smaller in size than what was proposed under the Build Back Better plan, but still includes some significant tax law changes. The bill includes tax law changes to raise revenue for the government, along with some tax deductions and credit changes. It also includes a provision for $80 billion in additional funding for the IRS.

Article

Depreciation Recapture: Paying the Piper When a Depreciated Property is Sold

When a property owner sells an asset that previously was used to offset ordinary income through depreciation, the gain is taxed through depreciation recapture.

Article

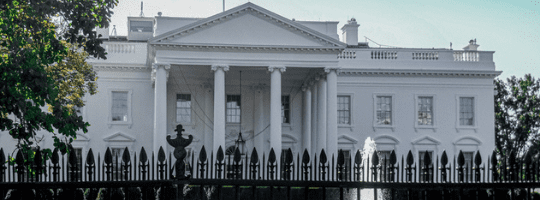

President Biden Signs $1.2 Trillion Bipartisan Infrastructure Bill

Learn more about the $1.2 trillion bipartisan infrastructure bill recently signed by President Biden.

Blog

Ohio’s New Pass-Through Entity Tax Election

Learn more about SB 246 which was signed into law by Governor DeWine in mid-June and will go into effect in September 2022

Blog

Important Update: New Requirements for Partnerships & S Corporations

On January 18, 2022, the IRS issued important updates to the instructions related to filing the new Schedules K-2 and K-3 for tax year 2021 for partnerships and S corporations.

Blog

Crossing State Lines | Examining The Hidden Costs And Liabilities Of Doing Business Outside Of Your State

Staying on top of nexus and state tax risk can help keep your business compliant and safeguard you from the hidden costs of doing business outside of your state.

Blog

Don’t Make These 10 Audit-Triggering Mistakes

Want to stay off the IRS audit list? Start by avoiding these 10 1040 faux pas.

Blog

New Guidance Issued To Help Business Owners Navigate The Choppy Employee Retention Credit (ERC) Waters

New notices from the IRS could impact your business.

Blog

Ohio’s Budget Bill Addresses Remote Work Challenges

Find out how H.B. 110 addresses state and local tax considerations in a remote work environment.