Business Resources For Minority-Owned Businesses & Women-Owned Businesses

This article is part of Rea & Associates’ Small Business Corner series, which is designed to address challenges and considerations regularly faced by owners of small- to mid-sized businesses. Check out past Small Business Corner articles at https://www.reacpa.com/small-business-corner.

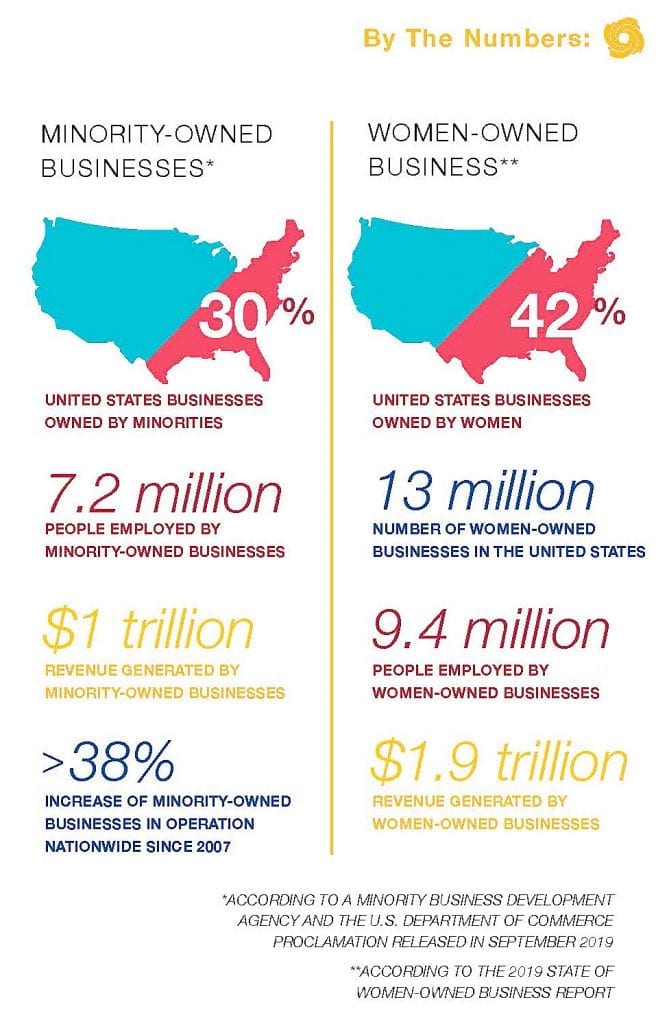

Minority- and women-owned businesses in the United States of America have a huge economic impact on their communities and the country as a whole. However, women and minorities still face some significant hurdles when it comes to owning and managing businesses today. For example, according to a report by The Brookings Institution, even though minority-owned businesses are rapidly growing and contributing to the U.S. economy more than ever before, black-owned businesses start with about one-third less capital than their white peers and have a harder time raising private investments from mainstream investment systems.

Lack of access to capital can be crippling for business owners, especially minorities. Entrepreneurs who start a business with existing access to capital such as property, stocks, good credit, and/or loans with reasonable interest rates have higher business success rates. According to the Office of Minority and Women’s Business Enterprises, entrepreneurs who seek to start a business without pre-existing capital face higher probabilities that their businesses will not succeed.

In addition to capital access, the impact of the pandemic has left many business owners without customers, resources, and funds; and for the majority, access to resources like the Paycheck Protection Program (PPP) have allowed them to somewhat recover from the recent events. More than 245 public companies applied for at least $905 million from the program, leaving many minority and small business owners without a chance to withstand the effects of the pandemic.

The best way to stay ahead of this in the event this does reoccur, is to establish relationships with your local banker, and create accounts with smaller banks or credit unions. Additionally, it is important to stay up-to-date on resources available to minorities. Here are a few we recommend:

Minority Business Development Agency

The Minority Business Development Agency (MBDA), part of the U.S. Department of Commerce, works to provide offer a wide array of services to minority-owned enterprises, including technical assistance, training, and access to capital, contracts, and new markets.

www.mbda.gov/page/business-services

National Minority Supplier Development Council

The National Minority Supplier Development Council (NMSDC), provides a variety of services for its members. Its most prominent role is being a connector that matches members with corporations that wish to purchase a portion of its products and services directly from minority-owned businesses.

Small Business Administration

The federal government’s Small Business Administration (SBA), offers certification to minority-owned businesses and provides training, executive education, and one-on-one consulting in the areas of marketing, accounting, opportunity development and capture, contract management, compliance, and financial analysis.

Additional Resources

It’s important to our economy and our communities that these minority- and women-owned businesses succeed, and Rea wants to be part of the solution. In addition to the resources included in this article, we have compiled an even larger list of resources for minority-owned and women-owned businesses on our website. These resources include links and

information about organizations, networking opportunities, articles, and podcasts.

While the majority of resources highlight Ohio-based resources, there are national and international resources as well.

Check out our Resource Center for additional resources for minority- and women-owned businesses.

We are always on the lookout for additional resources to help promote the advancement of minority-owned and women-owned businesses. If you would like to help us add to this list, please send us a message and include the resource you would like us to include on this page, the website URL, and additional information about who the resource serves and how it can make a difference.

By Becky Weiand (New Philadelphia office)