Author: Brian Kempf

Blog

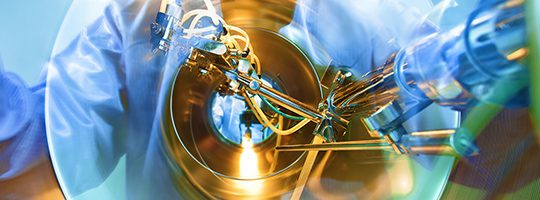

Manufacturing: Are You Taking Advantage Of R&D Tax Credits?

Don't leave R&D tax credits on the table.

Sep 29, 2020

Podcast

Episode 252: What’s Ahead For The Agricultural Industry?

COVID-19 hasn't made farming in Ohio any easier ... but Brian has some tips and answers on this episode of unsuitable.

Blog

How To Get Through The Dairy Farm Crisis

Slumping milk prices, rising input costs and a surplus of cows has triggered today's dairy farm crisis. What will dairy farmers do next?

Nov 19, 2018

Podcast

episode 160 – it’s planning season

Tax and estate planning for agricultural businesses is especially important in today's economic landscape. Listen to Rea expert, Brian Kempf, to learn why on this episode of unsuitable on Rea Radio.

Nov 19, 2018

Podcast

episode 160 – transcript

Read the "official transcript" of this episode of unsuitable on Rea Radio as Brian Kempf, tax planning pro, discusses why tax and estate planning is important for all industries (especially the agricultural industry).

Blog

Need Help Covering Employee Training Costs?

If you are looking to secure some training dollars from the State of Ohio for your business, put a plan in place today.

Blog

Grain Glitch Fixed, Unfair Advantage Averted

The provision that allowed for a 20 percent deduction based on gross sales is gone. In its place is a provision that eliminates the unfair advantage and increases the law's complexity.

Sep 18, 2017

Podcast

episode 99: how to maximize your real estate value (while minimizing liability)

The idea of owning real estate can be enticing, particularly when the land becomes a source of income. However, the reward of revenue comes with a number of associated costs: taxes, estate planning and other red tape. Brian Kempf, a principal in Rea’s Millersburg office, is particularly in tune with tax changes and the opportunities … Continued

Blog

Ready Or Not … It’s Time To Pay Up

Being on the wrong side of the IRS can be a difficult and extremely draining process. Read on to find out how you can settle any debt you may have and protect yourself moving forward.

Blog

Deducting Losses from Ponzi Schemes

Ponzi schemes are terrible, but they can often seem like things that happen to other people. We don’t worry about them because we think surely we’d never fall victim to this type of predatory business practice. But recently, two Ponzi schemes hit close to home and affected people in Rea’s local communities. Approximately 2,698 people … Continued