What Workflex In The 21st Century Act Would Mean For Paid Leave

It has always been a struggle for employers to design workplace flexibility policies that avoid conflict with the Family Medical Leave Act, Fair Labor Standards Act and other state and local laws. To attract and retain top talent, employers understand that flexible work schedules and programs are necessary. With that said, employers also know that the needs of their employees should balance with the needs of their business.

Read Also: Is Unlimited PTO Right For Your Business?

After numerous laws and calls from business groups, Congress has presented the Workflex in the 21st Century Act, which, if passed, will make paid leave a reality at the federal level. It will be greater than the leave required by state or local regulations but will not force employers to offer it. This bill is offered as an opt-in for employers, which gives them the option to go in a different direction with their paid leave system. Both employers and employees should do their best to understand what the act would mean for the workplace and the paid leave system.

What’s Being Proposed?

The Workflex in the 21st Century Act calls for employers to offer flex arrangements to employees who have worked for at least 12 months at their company and have logged a minimum of 1,000 work hours during that year. These flex arrangements can be everything from compressed work schedules and telecommuting to job sharing and flexible scheduling. The bill is designed to improve the paid leave system for employees in today’s work environment.

The following components of the bill are attracting significant attention:

- All full-time and part-time employees will have paid leave plan options. Employers will have the authority to design and decide on which plan meets their company’s and employees’ needs.

- It promotes company growth as the benefits thresholds will change as your company expands.

- The cost of the paid leave provided will now be paid by the employer, not taxpayers or employees.

- The Family and Medical Leave Act and its protections will not be affected.

The Purpose And Potential Benefits For Employers

The purpose of the Workflex Act is to offer employers a simple alternative to the many different laws and regulations with regard to paid leave. If passed, this bill would provide extra incentives for employers to offer paid leave to their workers by streamlining the process and promoting growth.

Employers who decide to opt-in will benefit from improved predictability by being able to follow a more structured federal program for paid leave instead of the complex and sometimes vague state and local laws. Furthermore, the voluntary opt-in of the Workflex Act would allow employers to offer employees a qualified flexible work arrangement plan under the Employee Retirement Income Security Act (ERISA).

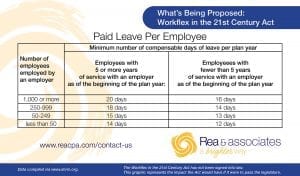

According to the Society for Human Resources Management, if the bill passes, the amount of paid leave an employer would have to offer would be dependent on both the size of the business and the tenure of the employee. For example, a business with more than 50 employees but less than 249, would have to provide employees with five or more years of service 15 days of compensable days of leave per plan year. Employees with five years of service with an employer are only eligible for 13 compensable days of leave per plan year.

Check out the following chart for additional details:

Remember, the Workflex in the 21st Century Act is only in the proposal stage. We will be sure to provide you with updated information as it becomes available. In the meantime, feel free to email Rea & Associates to learn more about the Workflex in the 21st Century Act or for additional HR tips and insight.

By Renee West, PHR, SHRM-SCP (New Philadelphia office)

Check out these articles for more helpful insight for employers:

Employment Laws Under The Microscope

Employment I-9 Workplace Audits Are Set To Increase In 2018

The information presented here is for informational and educational purposes only, and is not intended to replace the professional advice you would receive elsewhere. Consult with a human resources professional for additional insight and guidance as well as a trusted advisor who can expertly guide you to the best solution for your specific circumstance.