Do You Know If Your Business Owes Back Taxes?

Has your business sold products through Amazon.com? Are you sure? Even if selling on Amazon is not your primary means of sales, we’ve found that many larger companies will sell parts and supplies to their primary products through Amazon (a repair part for a large machine, for example).

Has your business sold products through Amazon.com? Are you sure? Even if selling on Amazon is not your primary means of sales, we’ve found that many larger companies will sell parts and supplies to their primary products through Amazon (a repair part for a large machine, for example).

Why do we ask? Because states are continuing to ramp up their aggression in developing legislation and policies to ensure online retailers are paying their fair share of sales and use tax.

Listen To: The State Tax Response To Federal Tax Reform

Amazon Fulfillment Centers Results In Nexus Issues for Business Owners

Amazon is now maintaining sales tax compliance in all or nearly all states, at least with regard to the products the company sells directly, but the products sold by third parties are another story…until recently that is.

As of Jan. 1, Amazon is now automatically collecting and paying sales tax on orders delivered into its home state of Washington. Other states are trying to get to third-party sellers through Amazon in other ways.

Many states with Amazon fulfillment centers (27 to date) are now using this physical presence to establish nexus for third-party sellers. The idea is that if you sell through Amazon, and Amazon fulfills your orders (they put your stuff in their warehouses and then they mail it to your customers) then a state can use the presence of your inventory in Amazon warehouses to make you comply with that state’s tax laws.

And because Amazon is now providing seller information with state tax departments, some businesses are at risk of having to pay hundreds of thousands of dollars in back income, franchise, and sales taxes.

Importantly, if you are considered to have nexus in a state due to you having property in an Amazon warehouse, then that company has exposure for all of their sales into a state – not just the sales made via Amazon.

How Quill v. North Dakota Has Shaped The E-Commerce Tax Landscape

Sales tax on e-commerce is governed in part by Quill v. North Dakota, a 1992 Supreme Court case that decided that a state cannot force a company to collect that state’s sales tax if that company does not have a physical presence in a particular state. The Wayfair case is set to either validate or modify that rule this year.

Read Also: What The State of South Dakota v. Wayfair, Inc. Means To Ohio-Based Businesses

Many states – including California, Colorado, Connecticut, Louisiana, New York, Vermont and Washington – have notice and reporting laws that require extra reporting from retail sales facilitators. More states have enacted, or are considering enacting, legislation to tax marketplace sales, like those through Amazon, Etsy, or eBay. Recent states that have enacted laws include Rhode Island and Massachusetts.

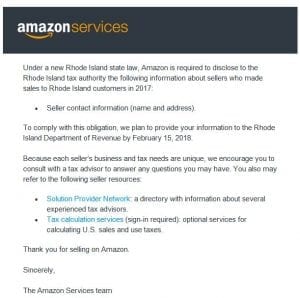

- Rhode Island recently passed notice and report laws. Amazon is now required to disclose a seller’s contact information to the state’s tax authority. Sellers are defined as those who made sales to Rhode Island customers in 2017. Amazon will provide a list of names and addresses of retailers that collected Rhode Island sales tax and those that they did not.

- Before Rhode Island, Massachusetts got a court order stating that Amazon must disclose information on third-party marketplace sellers with inventory in the state to its Department of Revenue. Amazon was notified that it had to disclose the seller’s name, address, phone number, federal tax ID number and the estimated value of a vendor whose inventory was stored in Massachusetts-based Amazon warehouses.

Amnesty Is A Thing Of The Past

In an effort to encourage third-party vendors to come into compliance with state tax laws, the Multi-State Tax commission developed the Online Marketplace Seller Voluntary Disclose Initiative. As part of this amnesty program, many states waived or partially waived back tax liabilities if companies took steps to collect the taxes moving forward. However, the initiative ended in 2017.

What we do know is that the trend of states cracking down on sellers conducting out-of-state business is set to continue. That means, businesses should take the time to become well versed in the sales tax requirements of each state in which they do business. When the US Supreme Court decides the case of South Dakota v. Wayfair later this year, we would expect states to change their laws to comply with the ruling and perhaps at that time many will offer new amnesty-type programs.

Do you sell products nationwide through an online marketplace like Amazon? You may owe back taxes – and that tax bill could get very expensive. Email a member of Rea’s state and local Tax team today to find out if you owe back taxes and discover how to maintain your compliance moving forward.

By Joe Popp, JD, LLM (Dublin office)