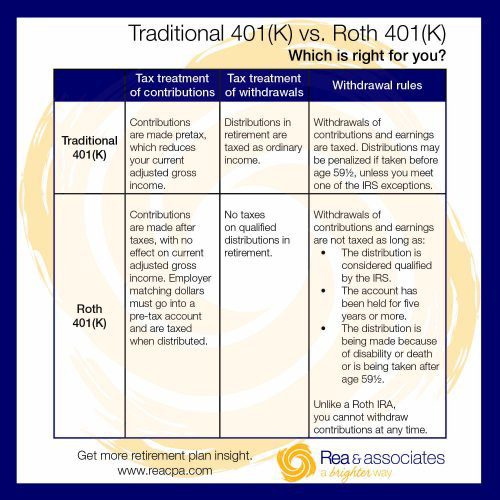

Are you wondering whether it makes more sense to use a Roth 401(k) or a Traditional 401(k) to save for retirement? Do you know the difference between the two? This article will hopefully clear things up a bit.

Generally speaking, when it comes to retirement savings, you have the freedom to contribute up to $18,000 per year. Or, if you are 50 or older, you can throw an extra $6K into the pot for a total of $24,000. Additionally, you can contribute to both types of accounts in the same year, as long as you keep your total contributions under that cap. But when it comes to taxes … there are some pretty significant differences.

A Little Strategy Yields The Best Results

If you prefer to pay taxes now just to get them out of the way, or you think your tax rate will be higher in retirement than it is today, then you may want to consider a Roth 401(k) as your retirement vehicle of choice. By taking advantage of this option:

- You shield yourself from potential increase in tax rates by the time retirement comes around.

- You give yourself access to a more valuable pot of money in retirement: $200,000 in a Roth 401(k) is $200,000, while $200,000 in a Traditional 401(K) is $200,000 less the taxes you will owe on each distribution.

This is particularly effective when you are younger or just starting out in your career since chances are pretty good that you will gradually move into a higher tax bracket as the years pass by. On the other hand, your Roth 401(k) contribution will reduce your paycheck by more than a Traditional 401(k) contribution, since it is made after taxes instead of before. That being said, if you think your tax rate will be lower when you retire than what it is now, then you may want to consider going with the Traditional 401(K) option. Especially since this option will help you avoid having to pay taxes on your contributions now, when your tax rate is higher.

But Wait, There Is More … Taking The Roth IRA Into Consideration

The following questions should also be considered before moving forward with a particular strategy.

- Are you eligible for a Roth IRA? Roth 401(k)’s do not have income limits, but Roth IRAs do. The Roth 401(k) is a chance to get access to the Roth’s tax-free investment growth if you earn too much to be eligible for the Roth IRA.

- When do you want to have access to your retirement money? The Roth 401(k) does not have the flexibility of a Roth IRA. You cannot remove contributions at any time. In some ways, due to the five-year rule, it is actually less flexible than a Traditional 401(k). Even if you are age 59 ½, your distribution will not qualify unless you have also held it in the account for at least five years. You can also withdraw your original contributions (not your gains) to a Roth IRA tax penalty free, which you cannot do with a Roth 401(k).

- How will it affect your Required Minimum Distributions in retirement? The account owner is required to begin taking distributions at age 70 ½ , but money in a Roth 401(k) can be rolled into a Roth IRA. This will then allow you to avoid those distributions and even pass that money on to heirs.

So what should you do?

You can split the difference and contribute to both accounts. Or you can switch back and forth throughout your career or even during the year, assuming your plan allows it. Using both accounts will certainly diversify your tax situation in retirement. You can email the retirement planning experts at Rea & Associates to learn more about these options.

By Paul McEwan, CPA, MTax, AIFA (New Philadelphia office)

Check out this article for more retirement plan insight: